Policy makers are also exploring options for taxing other forms of wealth besides property. What trends will persist in 2022.

What India Can Learn From Failure Of Malaysia S Gst

From Jan 1 to Mar 31 2022 the electricity tariff before the 7 per cent goods and services tax GST will grow by an average of 56 per cent or S00133 per.

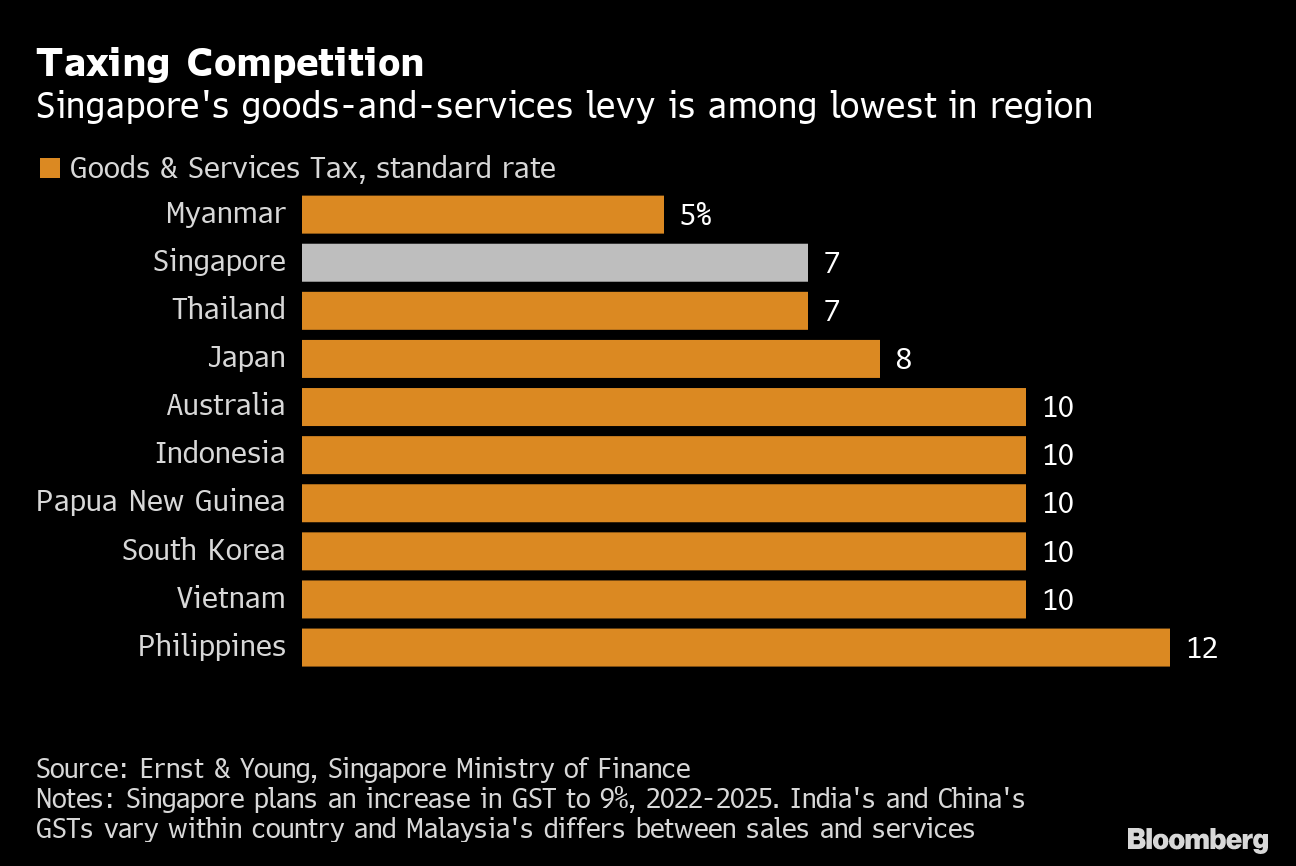

. The government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner rather than later. Even with the impact of the heightened alert measures in July and August the economy expanded by 71 year over year and 13 quarter over quarter in the third quarter. Plan for GST hike between 2022 and 2025 unchanged.

2 days agoThe government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner. The Government announced that Singapores Goods and Services Tax GST would be raised from 7 to 9 sometime between 2022 to 2025. The planned GST hike from 7 per cent to 9 per cent was announced in Budget 2018.

4225 What will 2022 be like for you. Singapores economic recovery from the pandemic has been faster than what the economists predicted at the start of 2021. Singapores GDP to grow 3-5 in 2022 says PM Lee as he outlines reasons for coming GST increase Budget 2022 will lay the basis for sound and sustainable government finances for the next stage of Singapores development said Prime Minister Lee Hsien Loong on Friday Dec 31.

1 day agoGovt has to start moving on GST increase in Budget 2022 as economy emerges from Covid-19 says Singapore PM Lee Saturday 01 Jan 2022 0808 AM MYT Prime Minister Lee Hsien Loong says the government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent. Government Social Safety Net. SINGAPORES electricity and gas tariffs are set to increase in the first quarter of 2022 according to state energy suppliers in their respective press statements on Thursday Dec 30.

3130 The new norm. The GST forms one important component of our system of taxes and transfers that also includes income and wealth taxes. A 22-year-old man was arrested on Wednesday Dec 29 for allegedly transmitting obscene materials through the online content platform OnlyFans said the police.

It was first introduced in 1994 at three per cent then raised to four per cent in 2003 and five per cent in 2004. From 1 st January 2022 the GST rate on fabrics has been raised to 12 percent from 5 percent and the GST rate on the apparel of any sale value has also been raised to 12 percent in comparison to 5 percent earlier at a cost of up to Rs. Before we move to raise the GST we will carefully assess the prevailing economic conditions as well as our needs at that point.

One political analyst said a GST increase in 2022 would also provide enough. In a Parliament debate on Tuesday Oct 5 Finance Minister Lawrence Wong said the plan to raise the GST between 2022 and 2025 remains unchanged. How will Singapore Bank Stocks fare in 2022.

2 days agoSingapores economy is now in a relatively stable position to raise the GST said political analysts and economists. Why Singapore living costs look set to increase in 2022. The planned GST hike from 7 per cent to 9 per cent was announced in Budget 2018.

2 days agoWhile a proposed hike in the GST currently at 7 had been delayed by the pandemic the government had said it would move ahead with the increase as soon as 2022. SINGAPORE - The plan to raise the. SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains unchanged.

SINGAPORE As Singapores economy emerges from Covid-19 the Government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent said. Various factors both global and domestic are driving up inflationary pressures which could mean Singapore consumers will pay more. 1 day agoSingapores Budget 2022 will be unveiled by Finance Minister Lawrence Wong on February 18.

The Government will have to start moving on the planned hike in Goods and Services Tax GST in Budget 2022 given that the economy is emerging from COVID-19 said Prime Minister Lee. 2100 Helping your fellow Singaporean. As most Singaporeans know the plan to raise goods and services tax GST by two per cent from the current seven per cent to nine per cent will happen soon.

3929 The future of employment and the Singapore job market. October 6 2021. A previously announced hike in the Goods and Services Tax GST will happen between 2022 and 2025 and sooner rather than later depending on the economic outlook said.

TIME TO BITE THE BULLET. Sunday 31 Oct 2021 0819 AM MYT. On Sep 4 the police received a report that the man had allegedly transmitted by electronic means obscene materials in the form of images and videos of his private parts.

The planned goods and services tax GST increase will take place between next year and 2025 - sooner rather than later and subject. GST hike to 9 will take place between 2022 and 2025. The GST in Singapore was last raised more than a decade ago in 2007 to seven per cent from five per cent.

2 days agoFirst announced in 2018 the increase in GST from 7 per cent to 9 per cent is meant to help Singapore meet rising recurrent spending needs especially in. 2500 Elderly who cant afford to retire.

Gst Singapore A Complete Guide For Business Owners

India Number Of Gst Taxpayers In India 2020 By State Statista

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

India Monthly Gst Collections 2020 Statista

Gst Singapore A Complete Guide For Business Owners

46th Gst Council Meet On Dec 31 To Discuss Rate Rationalisation The Economic Times

Singapore Boosts Spending To Counter Virus Economic Threats

What India Can Learn From Failure Of Malaysia S Gst

New E Invoicing Process In India Basics Of Gst E Invoicing Zoho Books Youtube